By Health In Five Writer

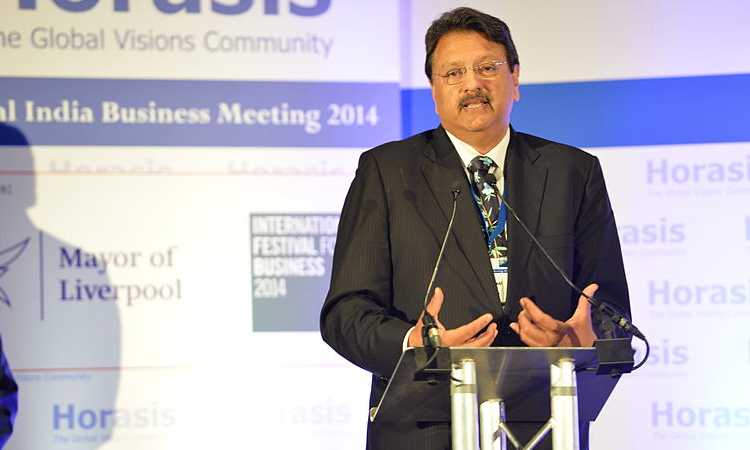

The Competition Commission of India (CCI) on Friday (September 11) communicated that it had approved acquisition of 20 per cent stake in Ajay Piramal-led Piramal Pharma by US-based global investment firm Carlyle Group.

Piramal Enterprises, in a regulatory filing, in June had said Carlyle Group Inc would buy 20 per cent stake in Piramal Pharma for around $490 million (over Rs 3,700 crore).

The estimated equity capital investment for Carlyle’s 20 per cent stake in Piramal Pharma would amount to around $490 million, it said.

The final amount of equity investment will depend on the net debt, exchange rate and performance against the pre-agreed conditions at the time of closing of the deal, it said.

PEL said the proceeds from the deal would be used as growth capital to expand existing capacities of its pharma business, fund potential acquisitions and to strengthen its balance sheets through short term deleveraging.

The Ajay Piramal promoted group has seen its balance sheet come under stress over the last year owing to its exposure to weakened corporate lenders and developers who borrowed from its non-banking financial company arm.

PEL’s market cap stood at Rs 30,079 crore as of Friday. The pharma business clocked 15 per cent CAGR over the last nine years closing FY20 with revenues of Rs 5,914 crore contributing to 41 per cent of the parent firm’s revenue. Piramal Pharma’s EBITDA stood at Rs 1,463 crore in FY20 with a 26 per cent margin.

The Carlyle Group is a global alternative asset manager whose affiliated investment funds own and control Curie.

“This transaction is one of the largest private equity deals in the Indian pharmaceutical sector, and is expected to close in 2020, subject to customary closing conditions and regulatory approvals,” Carlyle had said in a statement in June 2020.

“We are pleased to announce the strategic growth investment by Carlyle, a marquee global investor, in Piramal Pharma. This is an affirmation of the strength of our ability to build new, attractive and scalable businesses with a significant runway for continued organic growth and opportunities for consolidation. This infusion of funds will further strengthen our balance sheet and provide us with a war chest for the next phase of our strategy. We are pleased to have an investor of this caliber join the Piramal family and continue our stellar track record of partnerships,” Ajay Piramal had said in the statement.